Annika Khurana, Editor-in-Chief

@akhuranacourant

Throughout the college application process, hallways are dotted with conversations about representative visits, top programs, and essay prompts. Covering the cost of post-secondary education, however, is often overlooked before submitting applications, which may prompt hasty financial decisions near commitment deadlines.

With many college application deadlines completed and the final stretch before regular decision deadlines, financial planning is an essential component of the process. “On the bridge to adulthood, money is a huge conversation,” College and Career Center Coordinator Susan Carroll said.

According to Ms. Carroll, families should be having casual dinner table conversations about college payment plans. “College is very, very expensive,” Ms. Carroll said. “You don’t want to fall in love with a school, apply, and get in if it will not be financially feasible.”

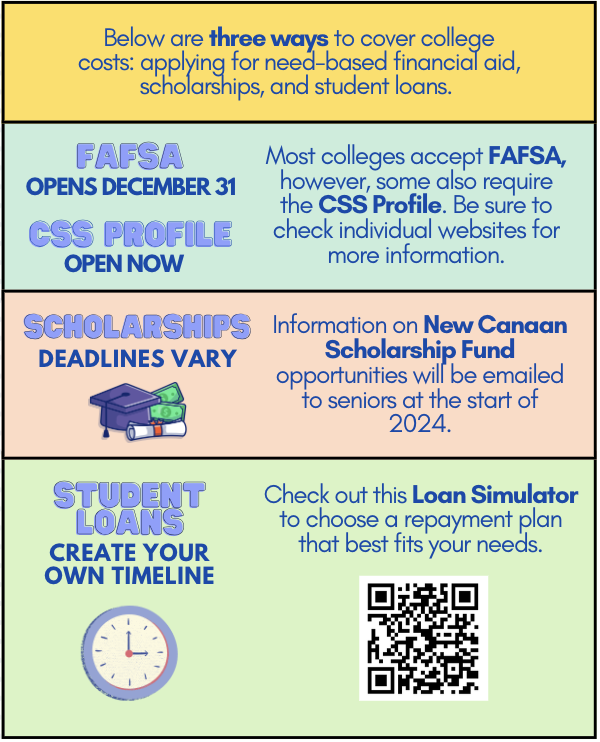

Planning is a key component of common financial plans, such as applying for need-based aid, merit scholarships, and federal student loans. To fully receive the benefits of these options, students and their families must complete the Free Application for Federal Student Aid (FAFSA) form.

This year, however, the form is undergoing several structural changes under the FAFSA Simplification Act. “You used to be able to fill it out on October 1st but that’s been moved to December 31st,” Ms. Carroll said. “If you’re a student who applied early decision, you already submitted your application without having any sense of whether there would be money for you at that location.”

According to the U.S. Office of Federal Student Aid, major changes to FAFSA include the replacement of Expected Family Contribution with the Student Aid Index, modifications to family definitions, and expanding access to Federal Pell Grants. These adjustments aim to expedite the financial aid process and ensure a comprehensive overview of a student’s ability to pay for college.

With this delay, completing other financial aid forms, such as the College Board’s CSS Profile, has become a priority to receive a timely tuition estimate. Once the updated FAFSA form is released, Connecticut students should submit it by February 15th to receive full consideration for need-based aid.

Furthermore, Ms. Carroll believes that all students should consider applying for merit scholarships, whether those offered in the community, through universities, or student organizations. “An email will be sent out with every application and the due date for local scholarships, such as Kiwanis, the New Canaan Scholarship Foundation, and the New Canaan Community Foundation,” she said. “They love hearing the stories of passionate students in the community and they’re very, very helpful.

“These details will be sent out after January so you’ll sort of have a sense of your college acceptances around that time, especially if you applied early,” Ms. Carroll said. “They all require an essay.”

Another way for students to effectively tackle college costs and limit student debt is to consider their future goals. Medical school and law school for, instance, call for a large expense on top of an undergraduate degree. “Maybe a student could do the work at Yale and would be a superstar, but Gettysburg College will make them their Presidential Scholar in biology,” Ms. Carroll said. “Instead of taking on 85,000 dollars a year at Yale, they could go to Gettysburg for free and put all the money saved toward medical school.”

Ms. Carroll encourages students to meet with their guidance counselors to ask questions and search for financial opportunities. This can be prioritized alongside academic check-ins. “Students can look for merit opportunities on financial aid websites and ask about them during college visits,” she said.